nd tax commissioner payment

Pay Property Tax On-Line. The credit is equal to a percentage.

N D Tax Commissioner A One Horse Race Inforum Fargo Moorhead And West Fargo News Weather And Sports

Register once for secure.

. No matter what method you use to file tax preparer software you purchase or one of. Who to contact for help Corporate Income Tax. This position processes work items related to employer income tax withholding and royalty withholding within the section.

Copyright 2022 North Dakota Office of State Tax Commissioner. Motor Fuel Tax North Dakota imposes a fuel tax on motor vehicle fuel gas gasoline special fuel diesel dyed diesel natural gas CNG LNG and aviation fuel jet fuel. You may be required to pay estimated income tax to North Dakota if you are required to pay federal estimated income tax and you expect your North Dakota net tax liability to be more.

Welcome to the North Dakota Property Tax Information Portal. Tasks associated with this position include. The North Dakota Office of State Tax Commissioner partners with Fidelity National Information Services FIS an authorized IRS payment processor to provide online tax.

It contains information about the operations of the Office of State Tax Commissioner tables of tax collections. Questions about paying your taxes online please contact. Complete the payment voucher below detach it from this page and mail it with the check or money order to.

One North Dakota Login and password to access multiple ND Online Services. An individual estate trust partnership corporation or limited liability company is allowed an income tax credit for conducting research in North Dakota. This publication is also created every biennium post legislative session.

County parcel tax information can be accessed by clicking on the County of your choosing using the interactive map above. This allows you to file and pay both your federal and North Dakota income tax return at the same time. Unemployment Insurance Tax.

Benefits of North Dakota Login. To make an electronic payment go to wwwndgovtaxpayment. 701-328-1249 How to make payment If paying by paper check or money order make the check or money order payable to ND State Tax.

127 Bismarck ND 58505-0599 Main Number. This position processes work items related to employer income tax withholding and royalty withholding within the section. North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner.

Tasks associated with this position include. Office of State Tax Commissioner PO Box 5622 Bismarck ND 58506-5622 2022 Make payable to. Payment Options The Treasurers office has provided the following Payment options for Real Estate and Mobile Home taxes.

City State ZIP Code Payment Amount Mail payment and voucher to. Its simple secure and easy to implement. Morton County Treasurer 210 2nd Ave NW Mandan.

Your Tax Refund Might Take Longer This Year

Christopher D Oswald Miller Hall Triggs Llc

Democratic Challenger For N D Tax Commissioner Floats Tax Breaks For Military Grand Forks Herald Grand Forks East Grand Forks News Weather Sports

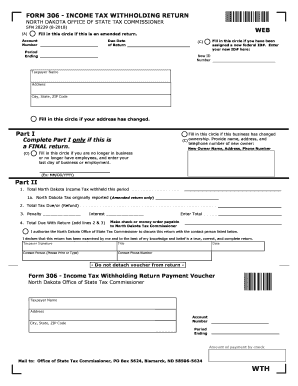

Nd Form 306 Fill Out And Sign Printable Pdf Template Signnow

North Dakota Tax Commissioner Ballotpedia

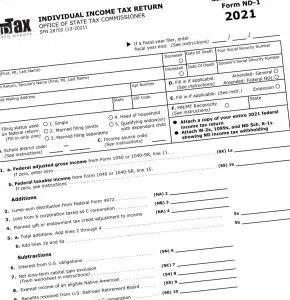

Prepare E File North Dakota Income Tax Return For 2022 In 2023

Bryan Bittner Director Research And Communications North Dakota Office Of State Tax Commissioner Linkedin

/cloudfront-us-east-1.images.arcpublishing.com/gray/A6GMNR3KZRISHPLZOIZYZQS7AU.jpg)

Nd Tax Commissioner Talks About How The Gop Tax Bill Benefits Those In Nd

State Democratic Chair Kylie Oversen Running For Nd Tax Commissioner

North Dakota Governor Looking For Tax Commissioner Appointee

Tax Commissioner Tells Gov Burgum He Will Resign Effective In January The Mighty 790 Kfgo Kfgo

Red Lodge Label Nd Tax Permit Red Lodge Label

County Of San Bernardino Treasurer Tax Collector

About The North Dakota Office Of State Tax Commissioner

Ndtax Publisher Publications Issuu

Ahlstrom Joins Edc Staff Grand Forks Nd

Fillable Online Nd North Dakota Office Of State Tax Commissioner One Time Remittance Form Please Check Appropriate Return See Page 2 For Instructions For Office Use Only Voluntary Sales And Use Tax